Last week, the bankruptcy filing of Germany’s most prestigious retail company, KaDeWe, came as a shock to many Germans. However, for some, it wasn’t surprising. So, what are the underlying facts behind this bankruptcy, and what lessons can textile retailers considering entering the German market draw from it?

Bankruptcy of KaDeWe and Its Impact on the Sector

If you’ve spent some time in Berlin, KaDeWe might be an important store for you. Similar to Harrods in London, KaDeWe is considered one of Europe’s largest and the world’s most significant shopping centers. Established in 1907, this iconic store plays a central role in the city’s social and cultural life by offering a wide range of luxury goods, gourmet foods, and the latest fashion products.

Located on one of the busiest streets in the west of Berlin, even during the times when the Berlin Wall divided the city, KaDeWe symbolized the wealth and prosperity of West Berlin. Going beyond just a shopping destination, KaDeWe serves as a center for cultural interaction and economic vibrancy, bringing together international visitors and the local community. So, what does it mean when a store with a customer base generally from the middle-upper to upper income group and primarily targeting those aged 30 and above declares bankruptcy?

Change in German Retail

While German experts often interpret this situation as a “strategy to get rid of past rent debts,” the problem is now more comprehensive. Retail is a significant industry for Germans. As a personal example, my mom studied merchandising and especially window design in a vocational school during the 1970s in Germany. Retail was a crucial business, with every detail, from the layout of shelves in the window to the salesperson building a relationship with the customer and even the ventilation specialist, being a separate expertise area. A significant population received training in this field, making it challenging to say that retail is coming to an end for this population. However, the traditional form of retail seems to be coming to an end.

Rise of E-Commerce: Preferences in Online and Physical Shopping

According to preliminary data from the German Federal Statistical Office, the revenue of the retail sector in Germany decreased by 3.3% compared to the previous year. This is a worrying development for the sector, especially with the rise of e-commerce. However, contrary to this overall shrinkage, the textile sector is notable with a real growth rate of 2.9%.

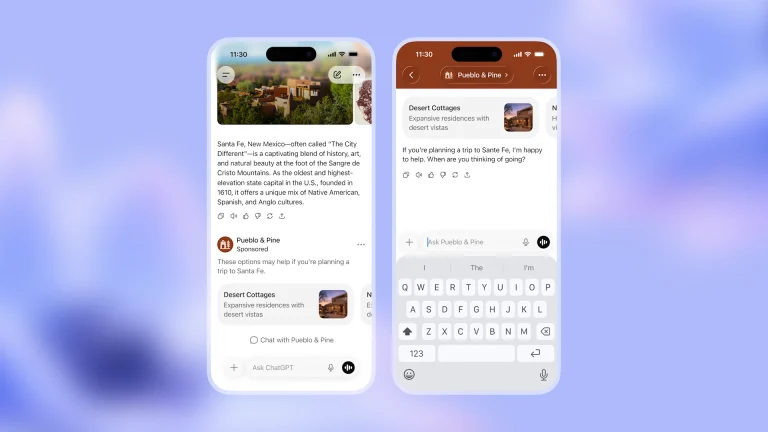

According to Eurostat data, online sales are expected to have a 42% share of annual sales of finished textile products in 2024; this figure was 27% before the pandemic. Although this rate jumped to 38% during the pandemic, even in 2021, when life returned to normal, it dropped to 35%.

Preferences for Online Textile Shopping in 2023

To better understand the current situation, looking at some data related to 2023 would be appropriate. According to research by Klarna and Neva in the third quarter of 2023, 47% of people prefer online textile shopping, while 25% prefer shopping from physical stores. The back-to-school season in the third quarter is an important period for the sector.

Zalando plays a crucial role in this online shopping trend. Zalando, a company that has been able to increase its quarterly revenue to 3 billion euros and received 260 million orders in 2022, with around 50 million active users, offers significant opportunities for textile companies. Considering that Amazon, eBay, and Otto are the top three most preferred online shopping sites in Germany, and the fifth is MediaMarkt, the largest sales chain for electronic products, its position is crucial. Also, according to Statista data, Zalando has the capacity to attract higher-income customers than other online sites. Thirty percent of its customers are core families, which is a significant opportunity in sales. There is so much data about Zalando that listing them all here would make the list go on forever, but it seems that Zalando is a golden goose for Turkish textile chains.

Of course, having your own website is crucial, but users tend to prefer purchasing from familiar online marketplaces due to the post-purchase experience they can trust. In terms of customer satisfaction, looking at Bitkom data, we see that while international shopping platforms like Zalando have an 80% preference rate among Germans, those preferring local retailers remain at 23%. There are also those who prefer both. Those opting for shopping through social media platforms remain at 10%. At this point, the most logical thing seems to be establishing visibility through Zalando and then embarking on a marketing journey to draw customers to your own site.

Recommendations for Turkish Companies

If Turkish companies are considering entering the German market, they should carefully plan their strategies. Trying to do retail in Germany with habits from Turkey could end in failure. It might be a good time to enter the German market, but careful thought should be given to “how” to do it. It is not a market where you can enter with habits from Turkey. Moreover, opening stores based on habits in Turkish neighborhoods or leaving the fate of your brand to a distributor is now even a worse choice than before. Your brand is your most valuable asset. Don’t spend it. Work with professionals and don’t shy away from the necessary investments. Then, a textile company that has succeeded in the German market will outshine the rest of Europe. Good luck in advance!

To learn about the services provided by Marker Groupe, you can contact us via the MarkerGroupe.com website or via the e-mail address hello@markergroupe.com.